Your bank is in your pocket, ready to help at each tap of your smartphone. That’s Fintech for you. FinTech, Financial Technology in full, is actually changing the way we do money today. From that all-important payment for that most favorite online game of yours to arranging a loan without stepping into the banking hall, FinTech makes financial tasks easier, faster, and more secure.

In this article, we will explore what exactly Fintech means, how it changed through the years, and why it matters to everyone: from kids who want to save up for a new bike to adults managing their investments. Let’s dive in!

Evolution of FinTech

You may be quite surprised when you find out that Fintech is much older than what you have thought. You remember the old movies where people are using credit cards? Well, it was one of the very first fintech innovations dating way back to the 1950s. In the 1960s came ATMs, which enabled everyone to withdraw money without having to go to the bank teller.

Where things really got interesting, though, was when the internet and smartphones came around. Online banking in the 1990s—checking your balance or moving money, from the comfort of your living room, was possible. Fast-forward to the 2000s, when mobile banking apps began cropping up. Today, you can pay for a slice of pizza or invest in stocks, all on your phone.

The Building Blocks of Fintech

Payments

Think about the way you pay for things today. You can Apple Pay it, Google Wallet it, or just tap your phone to make a payment. The secure digital wallet holds all your payment information inside and allows you to make your transaction. No more scrambling for cash or cards.

Borrowing

Need a loan? You no longer have to deal with mountains of paperwork or long bank queues. Websites like LendingClub, for example, allow lenders and borrowers to connect online directly with each other. It’s quicker and often cheaper.

Investment

Investing used to be for rich people only; now it’s open to all. Robo-advisors like Betterment provide an investment advice through algorithms. And with platforms like Robinhood, anyone can buy stocks with just a few dollars.

Personal Finance

Ever wondered where all that pocket money went? Mint and YNAB keep tabs on spending, provide budgets, and help in saving toward goals. It’s kind of like a personal finance coach in the palm of your hand.

Insurance (Insurtech)

There’s been a tough way to buy insurance-insurtech companies have made this easier. Platforms like Lemonade provide fast, more tailored insurance quotes at lower costs using AI.

Regtech

Keeping up with financial regulation is tough, but necessary. Regtech deploys technology to aid companies in compliance with the rules and in risk management efficiently.

Technological Innovations Driving Fintech

Blockchain and Cryptocurrencies

Blockchain is something like an ultra-secure digital ledger keeping account of all transactions. It’s the technology powering independent digital currencies like Bitcoin, which do not rely on traditional banks. Think of it like this: a big notebook that everybody can see but nobody can edit—that’s blockchain.

Artificial Intelligence (AI) and Machine Learning

Think of AI as your smart assistant who improves with time. In FinTech, it detects fraud, provides customer support, and renders investment advice. In a way, it’s like your financial guardian angel, always taking care of you.

Big Data and Analytics

Big data means analysis of a huge amount of information for trend identification. Financial companies make use of it in knowing customer behavior in order to improve their services. It’s almost like having a crystal ball that will help in predicting what customers want.

Internet of Things

IoT makes everyday devices smart by connecting them to the Internet. For instance, one can make payments using a smartwatch or track spending in real-time.

How Fintech is Impacting Traditional Financial Institutions

Fintech has shaken traditional banks, making them innovate or die. Many of them are now having their mobile apps and digital services just to fit in. Some team up with the very fintech startups they compete with.

For example, JPMorgan Chase has teamed up with OnDeck to offer online small business loans. Such collaboration helps a traditional bank like JPMorgan offer quicker and more efficient service.

How Fintech Benefits Consumers and Businesses

Consumers

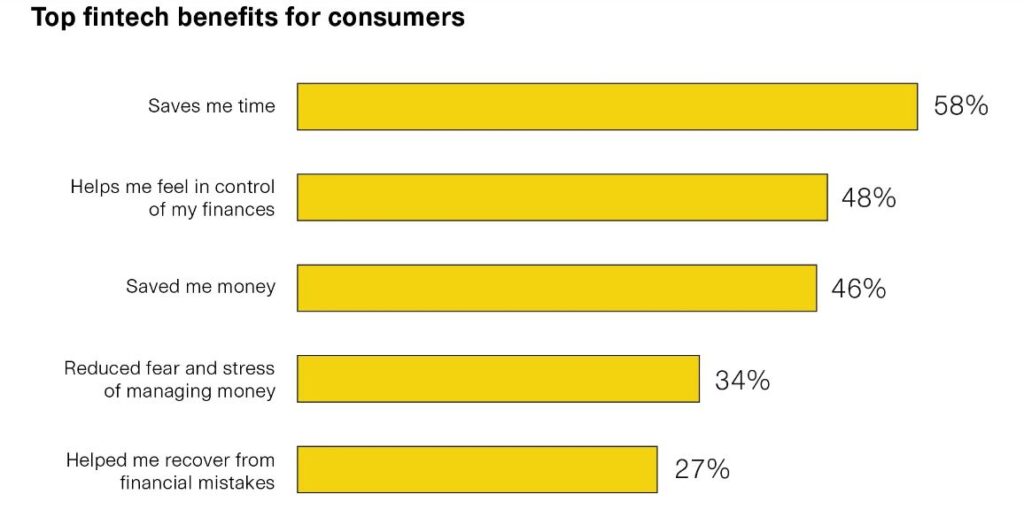

Fintech makes life easy for all. You can manage your money from anywhere and at any time through mobile banking applications. Digital payments are faster and more secure. Robo-advisors help you invest wisely. Besides, the secure nature of Fintech ensures that your data is safe.

Businesses

It eases operations and reduces costs for any business. The time is saved by automated payment systems, and cash flow is expedited by digital invoicing. Big data analytics let businesses know their customers in a much better way and offer tailored services.

Challenges and Risks in Fintech

Despite its many benefits, FinTech is not free from problems. For one thing, regulations are tricky to navigate, and another constant concern is related to cybersecurity. Companies should make sure that they protect customer data and comply with the laws.

Another challenge is how to obtain and, later, to retain consumer trust. Individuals should feel confident that their financial information is safe, and the services used are reliable.

Fintech: Future Trends and Opportunities

Fintech has a promising future ahead; exciting developments are in the pipeline. Emerging technologies like blockchain, AI, and IoT further drive innovation. The industry facilitates financial inclusions—providing services to underserved or hard-to-reach populations.

Imagine that everyone, no matter where he is or his income level, can access high-quality services offered by banks and other financial institutions. That’s a promise by Fintech.

Final Thoughts

Fintech has become a game changer in the way we do business related to money. Be it digital payments, online loans, robo-advisors, or blockchain, fintech makes financial services more available, efficient, and safe. Although various challenges lie ahead, the future also hosts great promise, and probably no other sector is better positioned to help make financial services better for all.

Next time you tap to pay or check your savings app on your phone, there will be a thought: You’re part of the FinTech revolution. And it’s just getting started.

The below resources helped me create this article